Nothing is challenging about investing for kids. If you want to put money away for your children, here are a few suggestions to discuss with your advisor.

Money is a game. Those who know the rules of the game win every time. Teaching your children financial management early on is one of the best things you can do for them. Make sure you invest early. Don’t let them become consumers, but rather investors.

How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.

-Robert G. Allen

Investing for your kids opens the door for them to start investing as well. Kids will do what they see their parents do, just give them a head start and later you can sit them down and show them what you started and help them to continue investing for themselves.

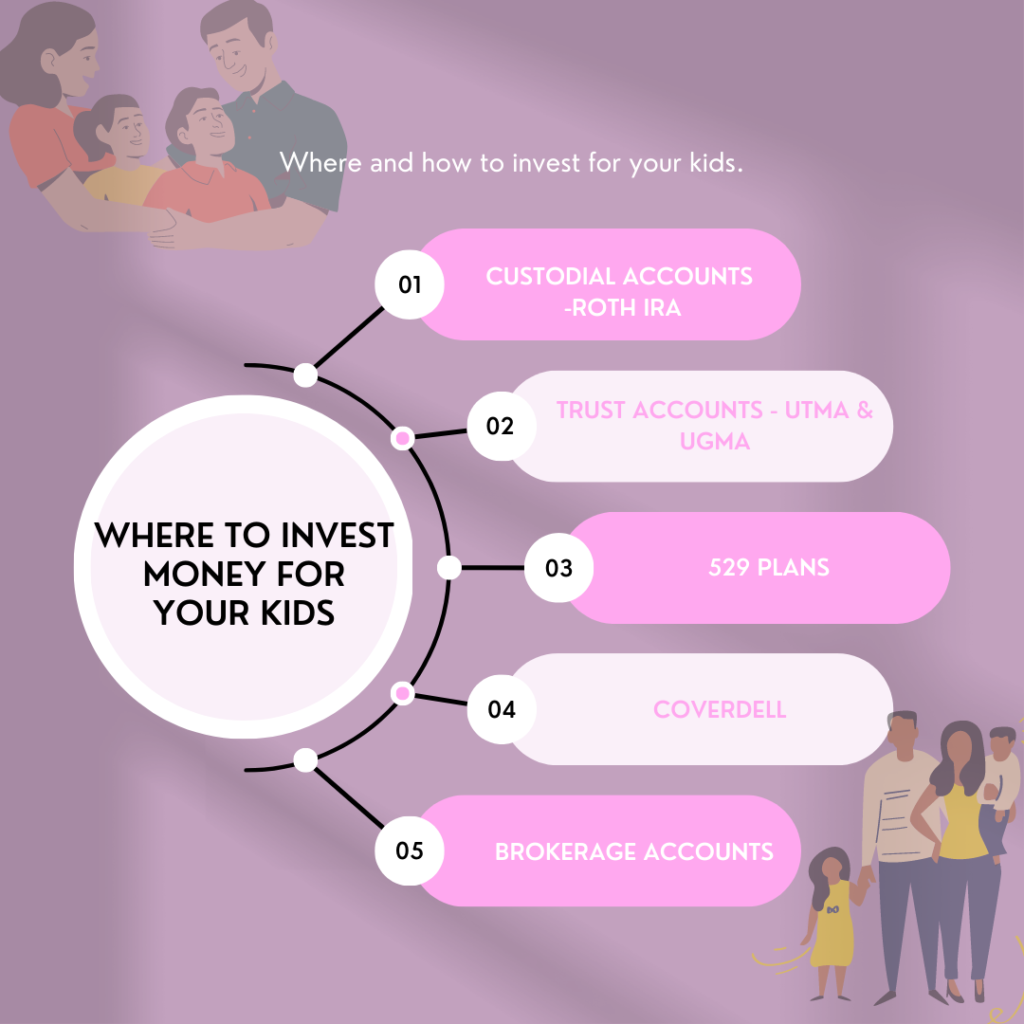

Here Are Some Accounts To Consider!

Uniform Gift to Minors Act and Uniform Transfer to Minors Act (UGMA/UTMA) are types of custodial trust accounts. A parent can open an account on behalf of a child, and they act as the account custodian until the child comes of age; however, the funds transfer to the kid at 18-25 depends on the state.

Coverdell: A Coverdell account is a type of education investment account. You can contribute a maximum of $2,000 per beneficiary per yea; however, there is an income limit. You can contribute tax-free to this plan, and if you use the funds to pay for qualified education expenses, it is tax-free.

529 Education Savings Plans: Like Coverdell except for the contribution limits almost 7 times more; there is also a way to put away up to 5 years in advance. Remember, these limits are not the same for all states. You have to check with your states to see what it is for you. Additionally, If the withdrawals are used for qualified educational expenses, they’re tax-free. As of June 2022, there are 15.92 Million 529 accounts opened. According to Collegesavings.org. Families are truly taking advantage of this amazing saving plan for their children. Contributions limits have also gone up to $17,000 in 2023.

Investment accounts: A brokerage account allows you to buy and sell stocks, bonds, mutual funds, and exchange-traded funds. It’s always possible to open one of those and later give the money to your children. Furthermore, opening a brokerage account give you the opportunity to buy stocks that your kids are interested in such as the companies who make the games they love, or the food they like to eat. It’s always a good idea to invest in the things that you already consume because your money is going to those companies anyway.

Custodial Roth IRA: Custodial Roth IRAs are Individual Retirement Accounts that a parent holds for the benefit of a minor who is earning income from a job or business.

Final Thoughts

The goal is to start early. The sooner you start to save, the less you will have to put away. If you have more questions and like to talk to us. Send us an email

“Before you can become a millionaire, you must learn to think like one. You must learn how to motivate yourself to counter fear with courage.”

—Thomas J. Stanley

It’s always a pleasure to chat with you all, please share in the comment below how you are investing for your little ones. Until next time! Happy NEw Year 2023! Let’s make it the best year yet. Don’t forget to check out our other post on how to save money on groceries. Read more here!

Disclaimer: All pieces of advice from the website are our opinion. We are not financial or estate planners, tax advisors, budget planners, credit counselors, lawyers, or debt managers. For related advice, individuals should consult an appropriately licensed professional. Before investing, an investor should consider a mutual fund’s risks, investment objectives, and fee expenses. All tax rates and interest percentages are hypothetical. The creators, producers, participants, and distributors disclaim any liability or loss arising from advice herein.

Teaching your kids about money and investing is so very important! Thank you for sharing the different options and steps to take.

Oh good to know, I have not thought to do this. We’ve got to start being smarter with our money.

This is such an amazing post! Thank you for sharing. I have bookmarked this page for future reference. I wish someone taught me all these options when I was a kid.

Such a helpful post! Great way to make sure our kids can get off to a good start in life! Thank you for sharing!

Such a helpful post! Great way to make sure our kids can get off to a good start in life! Thank you!

This is such an important topic and I really appreciate that you wrote about it. A lot of parents I work with (I’m a pediatric medical social worker) are only focused on getting through the month living paycheck to paycheck but your suggestions look at the long-term importance of investments for your children. Thank you!!

Great tips. Thank you for sharing. The information is very helpful 🙂